There’s more than one way to tackle fundraising for real estate deals online. It has become much easier to syndicate investments online thanks to new technology.There are multiple ways to approach syndicating, partnerships and crowdfunding real estate investments. One is having a ‘money ready a fund’. That means raising the money and then going to look for a property. Some prefer that method as it gives them the confidence in having all the cash in advance. The downside can be winding up with a lot of idle capital and having to make up for lost months of returns when it comes to payouts to investors.The other option is raising the money after the deal is vetted and ready to go. If you take this route, just be sure you have some verbal commitments in advance. Because you don’t want to end up having to go back to the seller to push back the closing date because you didn’t raise enough capital in time.Here is how the process works in seven simple steps…

Get the Deal Under Contract

Due Diligence

The Legal Stuff

Regulations

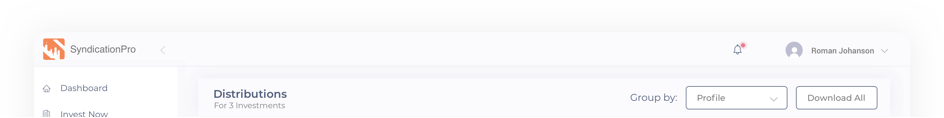

Publish the Offering Online

Raise Money

Close the Deal